The newest Martingale trade technique is a strategy whose goal is to ensure profitability across the long run. This is more of a finance management approach than simply a trading means, therefore use it with many options or steps. My personal question for you is, features someone has received long term victory with this strategy otherwise basically provides only obtained really lucky such earlier times.

Casino 1bet 150 free – Condition Measurements inside the Energy Exchange Procedures

One of several risks of using the Martingale method is the odds of rapidly shedding the entire deposit. The principle away from doubling wagers after every losses means nice investment, and in case some shedding positions takes place, the newest wager proportions can become therefore higher the individual seems to lose all of their money. This tactic will be for example unsafe in the event the a hold to cover possible losses is not felt. The brand new martingale approach is made in the eighteenth-millennium France as a means to own gambling.

‘s the martingale means you are able to to use for other designs trade?

The fresh lengthened you employ the methods, the better the odds that you’ll find a disastrous shedding move one wipes away all your previous earnings. An alternative method to the brand new Martingale technique is labeled as an excellent contrary Martingale, the place you twice as much wager once you funds, and you may halve forget the when taking a loss. This strategy has got the possibility to create your membership quickly, however, delivering earnings out of the account is essential.

Again, your twice your trade while increasing in order to $20, with the expectation away from a winnings to recover your own losings. When you sooner or later victory, there’ll be regained the losings making an income equivalent to your brand-new change. Although it is a good concept to quit loss, their potential to continue losing are limitless and your winnings have a tendency to not necessarily be extremely nice. However, the brand new Martingale approach needs extreme financing, considering the need to twice as much exchange proportions after each loss. A properly-outlined exchange bundle is always to establish compatible currency sets you to definitely exhibit enough volatility to have possible money when you are handling exposure efficiently.

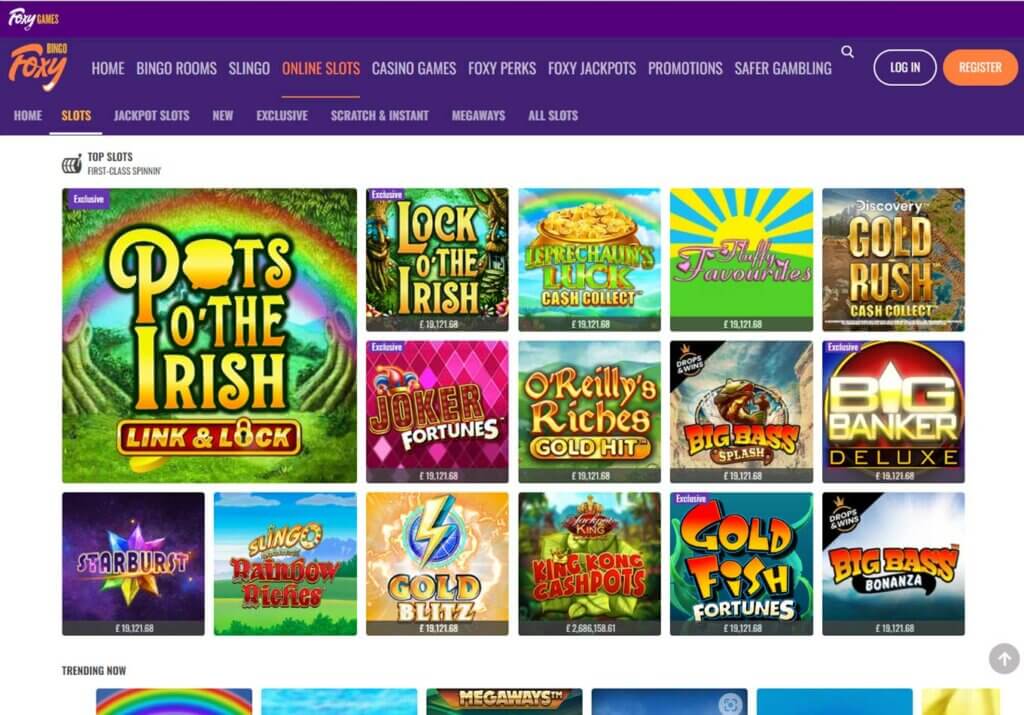

Requirements for making use of Martingale inside the Blackjack inside the NZ Gambling enterprises

It restriction ‘s the fact away from gambling, whether it is in the brick-and-mortar gaming associations otherwise The newest Zealand casinos on the internet. All of the lender games provides regulations designed to give the casino a keen border more your. You can view the way the 11 unfortunate rounds will make you shell out an unbelievable NZ$10235 on the casino, which is short for much of your budget. Obviously, achievement for the twelfth bullet tend to retrieve all earlier losings, but insofar as you can place the bet. For many who remove a 7th change, you are now down $a dozen,700 and now have to chance $several,800 making right back the losings. The new Martingale approach is actually originally found in playing at casinos.

swinging average Effortless Strategy for Trading Bitcoin All the-Time Levels

The brand new Martingale strategy is based on the idea away from indicate reversion inside exchange, and therefore opines your price retraces to the their suggest just after particular go out. Because the marketplace is attending opposite will ultimately, it thinks the fresh trader is to help the matter spent because the price drops —inside anticipation from a future increase. However, instead a countless way to obtain money to save paying, the strategy won’t work.

For example, when the a loss is casino 1bet 150 free experienced in the first trading, the position dimensions are twofold within the next change. For the earliest profitable change, all the previous loss is actually recovered, and you may a small money is attained. For instance, having fun with tech research or following news may help more precisely choose entryway things, and therefore reducing the likelihood of losings plus the must double bets.

Considering this strategy, the brand new gambler doubles upwards the positions, searching for this a great hands otherwise big winnings so you can terminate aside loss. As an alternative, the brand new investor might take a bigger chance by repeating the methods for a long period. The brand new Martingale Experience an investment means, specifically used by the individuals who wager inside the casinos and you may betting.

To own Profitable Series, Return to the first Wager

The new Martingale strategy sells big threats such as the odds of high economic losses, margin phone calls, and you may done membership destruction while in the expanded losing streaks. It’s imperative to watch out for these dangers before engaging in so it gambling method. You twice your own wager once more for the 3rd bet, which increases to $cuatro. Regrettably, your own shedding move continues, bringing you as a result of $step 3. To date, you do not have enough currency in order to twice off, and so the finest you could do is choice the sleep. So it condition portrays the significance of an acceptable money also provide inside the rendering it strategy works.

By the increasing (otherwise significantly increasing) the positioning proportions after each and every dropping change, traders can also be effectively average along the admission speed. This method draws crypto lovers who’ve a lot of time-identity trust inside the a particular cryptocurrency but predict short-identity rate motion. Broadening positions through the dips permits buyers so you can benefit from speed reversals and eventually enjoy the cryptocurrency’s upward path. One of the important aspects of the reverse Martingale algorithm are understanding when to stop. Although this means can cause extreme growth, it is possible to reduce all money if you still bet once a loss of profits.

Even although you start by only $5, a burning move out of 7 wagers usually lead you to set up $640 for another choice – 128 minutes the main city your already been that have. Clearly, doubling the wager after each and every loss are able to turn on the an excellent precarious and you can pricey state quickly. We would like to discuss the fundamental drawbacks of your Opposite Martingale method. I would ike to give you an even more outlined explanation of the opposite Martingale gaming method.

Really, the brand new Paroli technique is the contrary of your Martingale program, and it is also called a keen Anti Martingale approach. The new Paroli roulette means needs participants to double the bet number once a loss. It reverse approach is founded on the notion of capitalising to your effective lines as opposed to recovering losings. The reverse Martingale strategy is a premier-chance and you can higher-reward means.

To start by using the Martingale strategy to the Wallet Solution, the initial step is to discover a trade for the minimum choice. The new asset has already been chose, and today it is important to influence the marketplace guidance – when it tend to rise otherwise slide. Traders generally fool around with technical study or display reports making an excellent much more told prediction. Since the assistance is chosen, the fresh trade is exposed for the minimum stake, such as, $1.